Is It Essential To Support Your Employees In Managing Their Budget?

Today, living paycheck to paycheck is a reality for many workers. Financial stress has a direct impact on productivity, engagement, and employee retention. In 2024, 43% of employees report being financially stressed, and 56% say it affects their concentration at work.*

As an HR manager or benefits lead, you have the opportunity to take action. Providing budgeting tools and financial education programs can reduce employee stress, improve performance, and boost engagement.

Benefits for your employees… and your company!

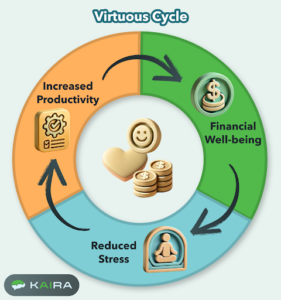

Helping your employees manage their budget isn’t just a personal benefit—it’s a strategic lever that positively impacts your entire organization:

✔ Reduced absenteeism and turnover – Less financial stress means more stable teams

✔ Increased productivity and engagement – A calm employee is more focused and effective

✔ Enhanced employer brand – Offering financial support increases your attractiveness to top talent

✔ Optimized HR costs – Fewer departures, lower recruiting and training expenses

✔ Better workplace climate – A less stressed team creates a more positive, collaborative environment

Budgeting basics for greater autonomy and financial health

Providing easy access to practical budgeting tips and tools can help employees regain control of their finances. Here’s a simple model you can recommend:

1. Take stock of income and expenses.

Encourage your employees to draw up a clear picture of their financial situation:

- List all sources of income (salaries, bonuses, family allowance, etc.).

- Identify all expenses (student loans, credit cards, etc.) with their interest rates.

? Tip to share:

- The “avalanche” method involves paying off high-interest debts first.

- The “snowball” method starts by paying off small debts to encourage motivation.

2. Set realistic financial goals.

Employees need to learn how to set measurable, achievable short- and long-term goals:

- Short term: example – eliminate high-interest credit cards within 6 months.

- Long-term: set aside a budget to create an emergency savings fund of one month’s salary within 1 year.

- Practical tip: A financial support program, such as financial literacy training, can help them better structure these goals.

? Good to know: An ideal emergency fund covers 3 to 6 months of essential expenses

3. Create a simple monthly budget.

Employees can use a basic budget like this one:

| Income | Fixed Expenses | Variable Expenses | Savings & Debt Repayment |

| Salary | Rent / Mortgage | Groceries | Emergency Fund |

| Bonuses | Bills (electricity, phone, ect.) | Entertainment | Debt Payments |

| Other Income | Transportation | Miscellaneous | Project Savings |

Once the budget is in place, the goal is to free up margin to accelerate debt repayment and start saving.

4. Monitor your budget regularly.

Encourage your employees to review their budget each month to adjust for unforeseen circumstances. They can also use financial management apps to stay on track..

Conclusion

Employee financial well-being is a major strategic issue for today’s businesses. By providing concrete tools to help them manage their budget, you support their personal and professional growth—while strengthening your company’s performance.

Investing in your team’s financial support means gaining in engagement, stability, and productivity. Choose a calmer, more efficient workplace—starting now!